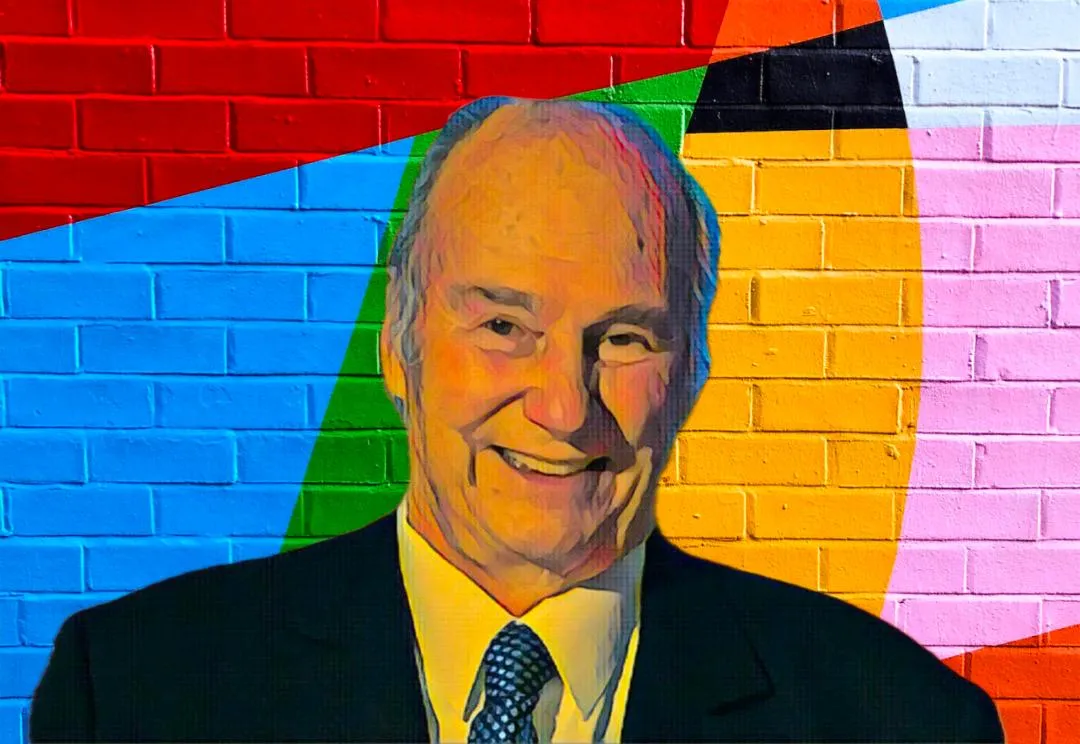

Shah Karim al-Husayni, the Aga Khan IV, has experienced a notable rebound in the value of his stake in Jubilee Holdings, following a recent surge in the insurer’s share price on the Nairobi Securities Exchange (NSE).

The Aga Khan IV, who owns a 37.98 percent stake in Jubilee Holdings through The Aga Khan Fund for Economic Development, saw the value of his 27,528,739 shares grow by Ksh220.23 million ($1.7 million) over the past 10 days.

This rebound marks a significant recovery after a $1.65 million decline between October 15 and November 5.

Jubilee Holdings Leads East Africa’s Insurance Sector

As East Africa’s first and largest composite insurer, Jubilee Holdings serves over 1.9 million clients across Kenya, Uganda, Tanzania, Burundi, and Mauritius. The insurer’s total assets now stand at Ksh254.5 billion ($1.97 billion), solidifying its position as a key player in the regional insurance market.

Since November 12, Jubilee’s share price has risen by 4.94 percent, climbing from Ksh162 ($1.25) to Ksh170 ($1.31). This has boosted the company’s market capitalization to over $90 million and increased the value of Aga Khan IV’s stake from Ksh4.46 billion ($34.44 million) to Ksh4.68 billion ($36.14 million).

Investment Outlook

While the recent surge has bolstered Aga Khan IV’s portfolio, Jubilee Holdings’ stock remains down 8.11 percent year-to-date. A $100,000 investment in the insurer’s shares at the start of 2024 would currently be worth $91,890, reflecting a loss of $8,110.

This latest development underscores Jubilee Holdings’ resilience in East Africa’s insurance sector, while reaffirming the Aga Khan’s influence and continued commitment to driving growth in the region’s financial and investment landscapes.

More Stories

Kenafric Expands into East Africa’s Stationery Market After Acquiring Economic Industries Ltd

Reckitt Partners with Naivas to Expand Access to Quality Hygiene and Health Products in Kenya

92% of Developers Believe AI Agents Will Boost Their Careers, New Research Shows