Equity Bank Kenya has been recognized as the top global performer by the International Finance Corporation (IFC), a member of the World Bank Group, for the 2023 Climate Assessment for Financial Institutions (CAFI) Awards for Climate Reporting.

Equity Bank reported the highest number of transactions for climate-related financing among the 258 participating financial institutions globally. CAFI is a tool developed by the IFC to enable its clients and partners across 210 countries to report on their financing activities for climate-related projects.

Equity Bank Kenya supported a total of 47,593 households and businesses in adopting adaptive and mitigating solutions to address the negative impacts of climate change. The support ranged from climate loan facilities as low as KES 6,000 for purchasing energy-efficient cookstoves in the retail sector to as high as Kes 8.54 billion to finance renewable energy distribution from renewable sources, including hydro, geothermal, and wind. These efforts have resulted in an overall reduction of 39,917.4 tons of CO2eq annually.

By October 2023, Equity Bank Kenya had disbursed Kes 24.7 billion as follows:

Climate adaptation and water efficiency – 66%

Energy efficiency and transport – 28%

Renewable energy – 6%

A significant proportion of the funding was used to support climate-smart agriculture, building resilience for farmers and farming ecosystems, which aligns with the agriculture pillar and lead the social and environmental transformation, another pillar of the Group’s Africa Recovery and Resilience Plan.

Commenting on the recognition, Equity Group Managing Director and CEO Dr. James Mwangi stated, “Equity is committed to playing a significant role in climate change mitigation and adaptation by providing appropriate financing and capacity development that helps the region decarbonize and build resilience. By being recognized as the Bank with the most transactions, Equity is creating a broader impact and reach for local communities and businesses. The Bank continues to work towards supporting Kenya’s goal of combating climate change by reducing its carbon emissions by 32% by 2030 and building resilience, as outlined in the National Determined Contribution.”

In 2019, Equity Bank Kenya entered into a partnership with the IFC for a $100 million facility for onward lending to climate-related projects. Equity matched the IFC facility, demonstrating its commitment to climate finance.

As of June 2023, IFC had committed $15.2 billion to climate-related projects through more than 210 emerging market financial institution partners, leveraging an additional $5.8 billion.

“CAFI continues to be a critical tool for accountability and progress in aligning financial flows toward the goals of the Paris Agreement,” said Tomasz Telma, Global Director, Financial Institution Group, IFC. “IFC’s work with banks and other financial institutions helps scale up climate finance activities and measure investments earmarked for climate, vital for our clients to realize their climate impact.”

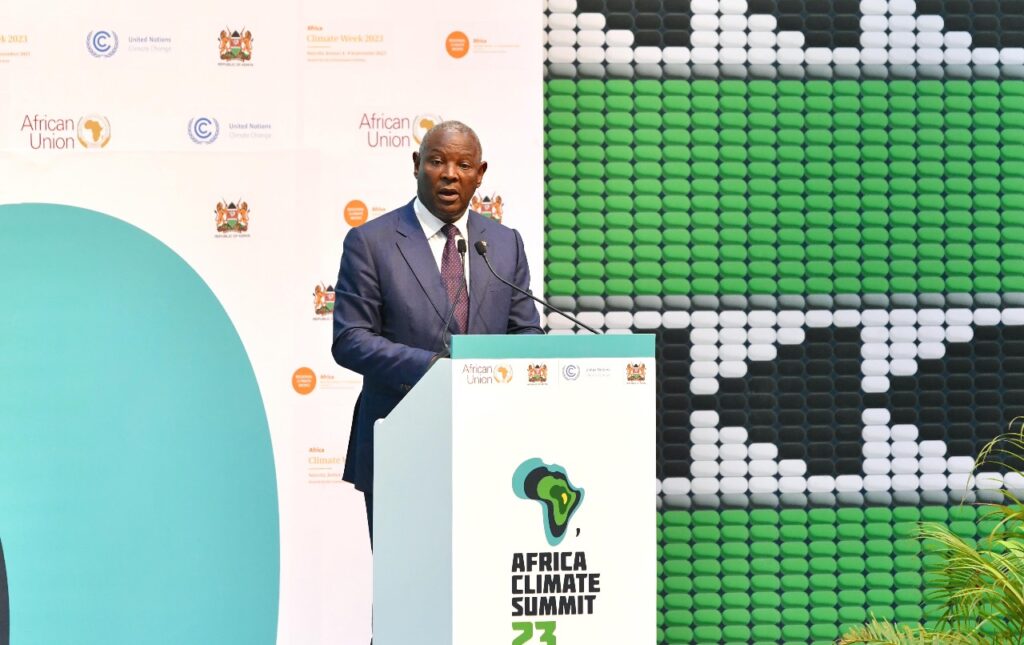

Equity Group has been at the forefront of championing climate change adaptation and mitigation among the continent’s private sector. In September 2023, when Kenya hosted the first Africa Climate Summit, Dr. Mwangi led a delegation from the continent’s private sector in discussions on how the sector can help drive Africa’s green growth agenda and climate financing.

“Africa’s potential for transformative sustainable development is immense, and as part of the continent’s private sector, we are honored to be leading this charge. With 40% of the critical minerals needed for the energy transition and almost 60% of the arable land required to address global food insecurity, Africa holds the key to unlocking a sustainable future. By embracing smart and responsible practices, we can harness these resources to create diversified wealth creation opportunities that will empower our people and drive positive change across the continent,” he added.

Equity’s commitment to managing climate change through the lens of people, climate and nature is not just reflecting in its lending activities but also reflected in the work being done to reduce its own environmental footprint and its commitment to sustainable development as reflected in its twin-engine business model, which positions community well-being alongside business success. The Group has continuously invested in financing energy and environment projects, food and agriculture, health, education and leadership, enterprise development and financial inclusion, and social protection as key pillars of its social impact initiatives.

Through its social impact investment arm, Equity Group Foundation (EGF), the Group has facilitated the planting of 23.3 million trees to bolster Kenya’s forest cover. Additionally, Equity has distributed 408,756 clean energy products to households and institutions, promoting the transition from fossil and wood fuels. Furthermore, the bank’s climate-smart agriculture initiatives have reached 3.8 million farmers, empowering them with sustainable farming practices.

Read also: Equity Group’s CEO Calls for Increased Advocacy for Capital Inflows to Fund Green Projects in Africa

Equity Group is set to play a crucial role as the implementing partner in the newly launched Africa Rural Climate Adaptation Finance Mechanism (ARCAFIM). The mechanism, introduced by the UN’s International Fund for Agricultural Development (IFAD) and partners, aims to provide tailored finance to support small-scale food producers/farmers and rural microenterprises in Kenya, Rwanda, Tanzania, and Uganda in adapting to climate change. Equity Bank Kenya, Rwanda, Tanzania and Uganda (subsidiaries of Equity Group Holdings), will contribute US$90 million to this initiative. IFAD will channel an additional US$90 million, with funding from various sources, making a total of US$180 million dedicated to climate change adaptation loans. The innovative financing model integrates blended finance and encourages private sector participation through a risk-sharing mechanism, marking a pioneering effort in climate change adaptation financing. The collaboration seeks to trigger systemic change in climate change adaptation financing and reduce poverty and hunger in Eastern Africa.

More Stories

George Wachiuri: Vipingo Prime Offers Investors a Piece of Coastal Paradise

Nairobi Environment Chief Honored by International Police Organization for Stewardship

St. George’s University Celebrates Over 1,035 Residency Matches in 2025, Continuing Reign as Top U.S. Doctor Producer